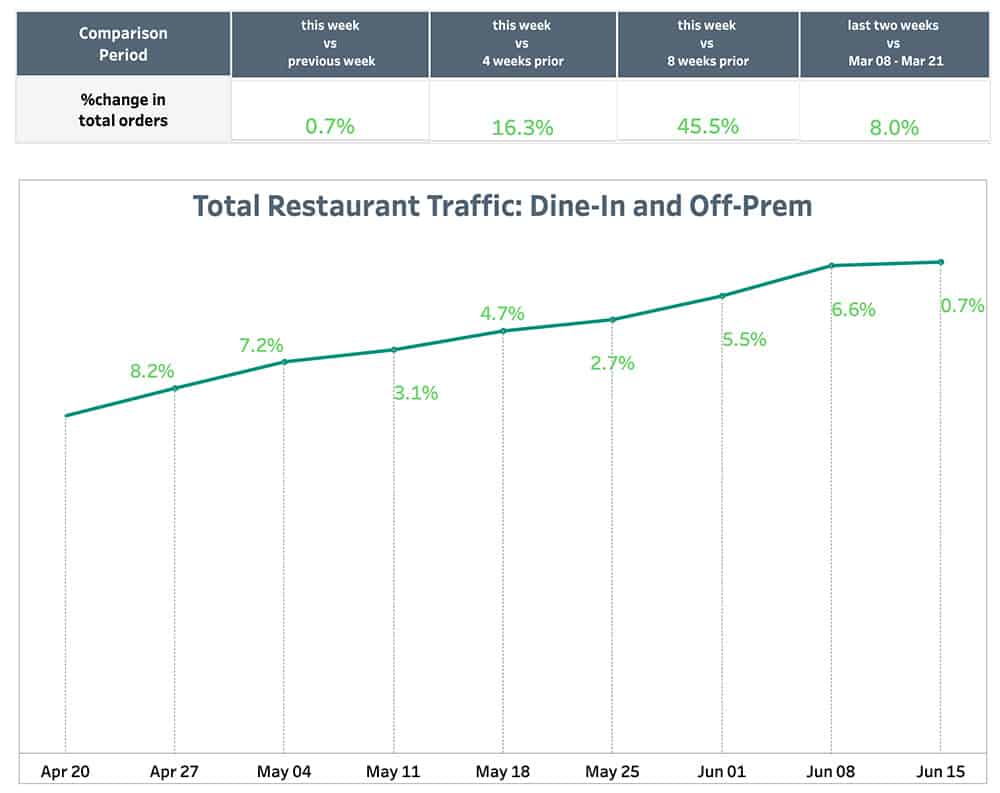

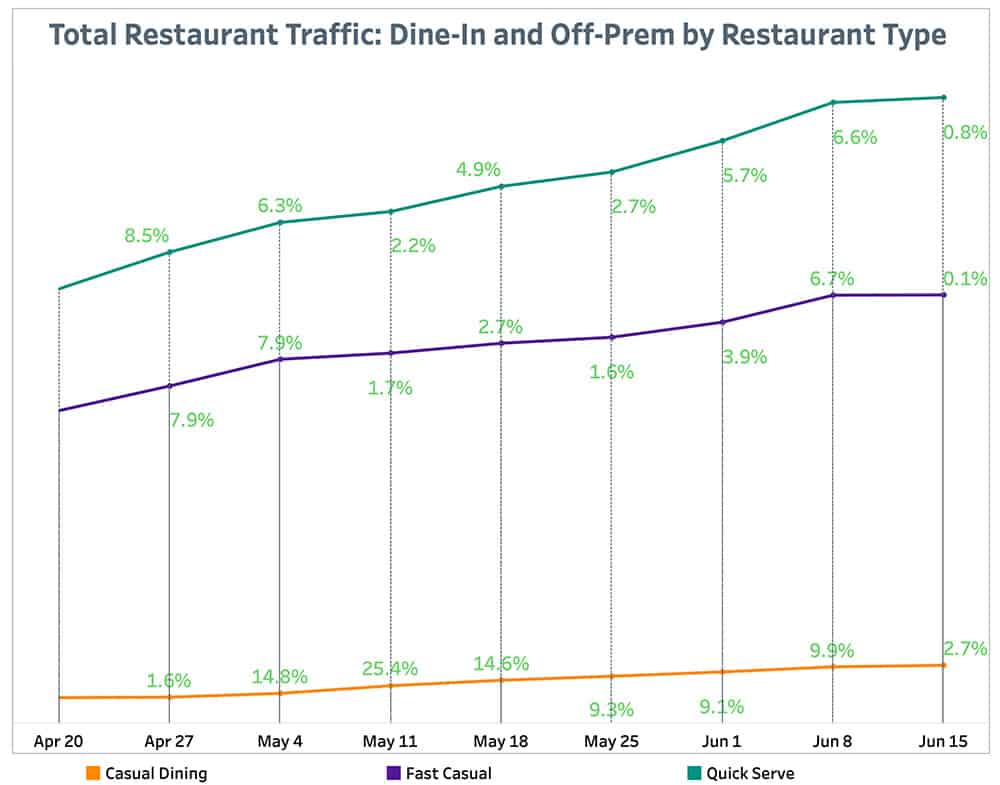

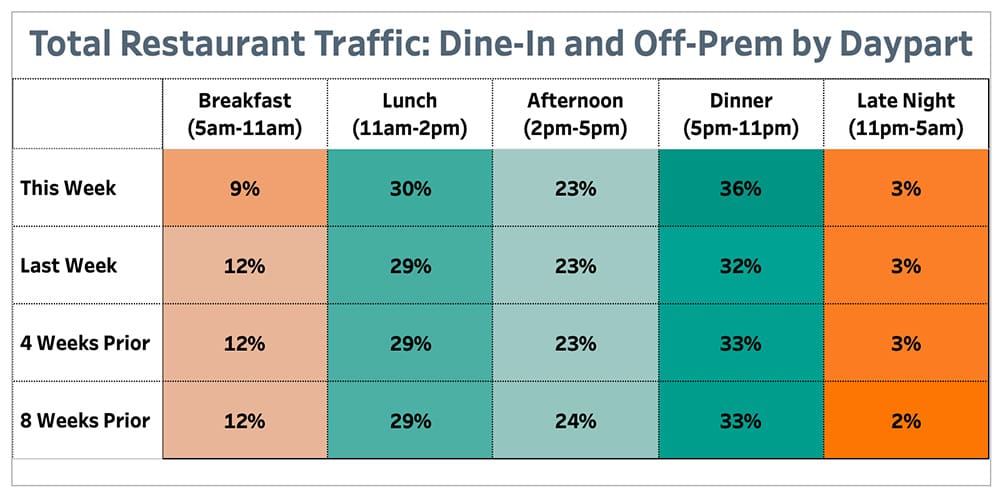

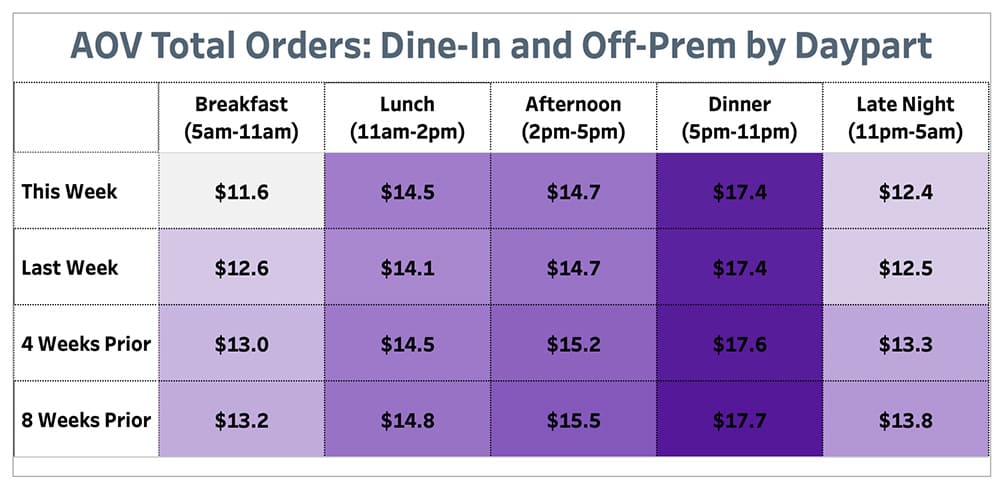

Total Restaurant Traffic

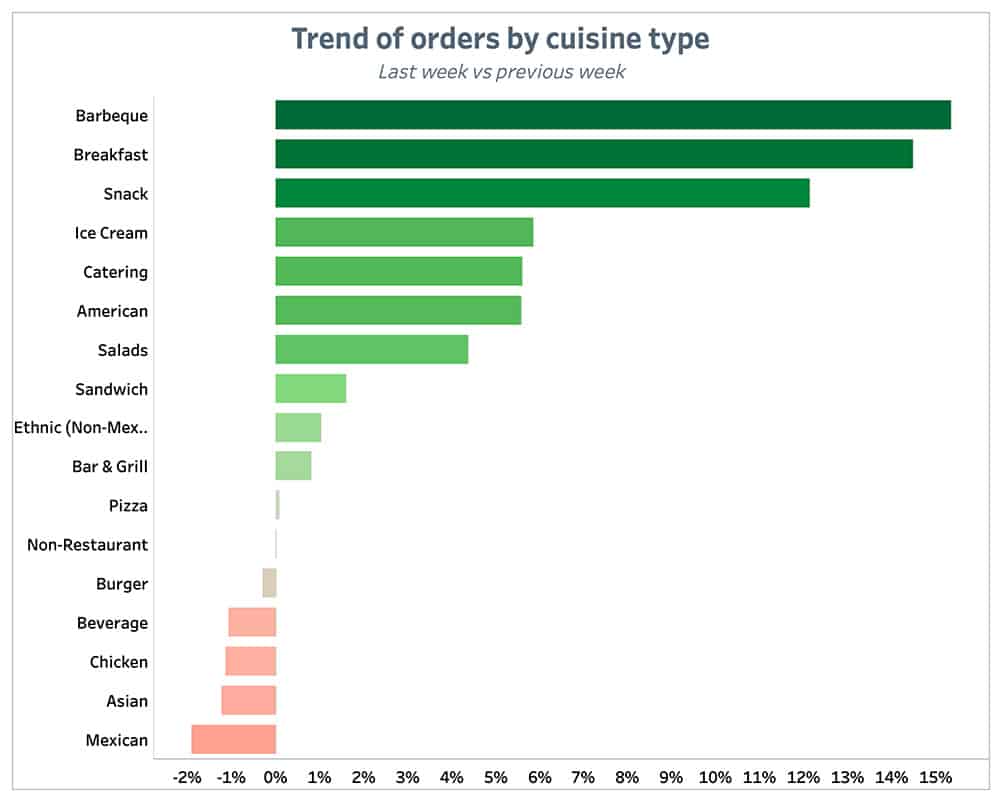

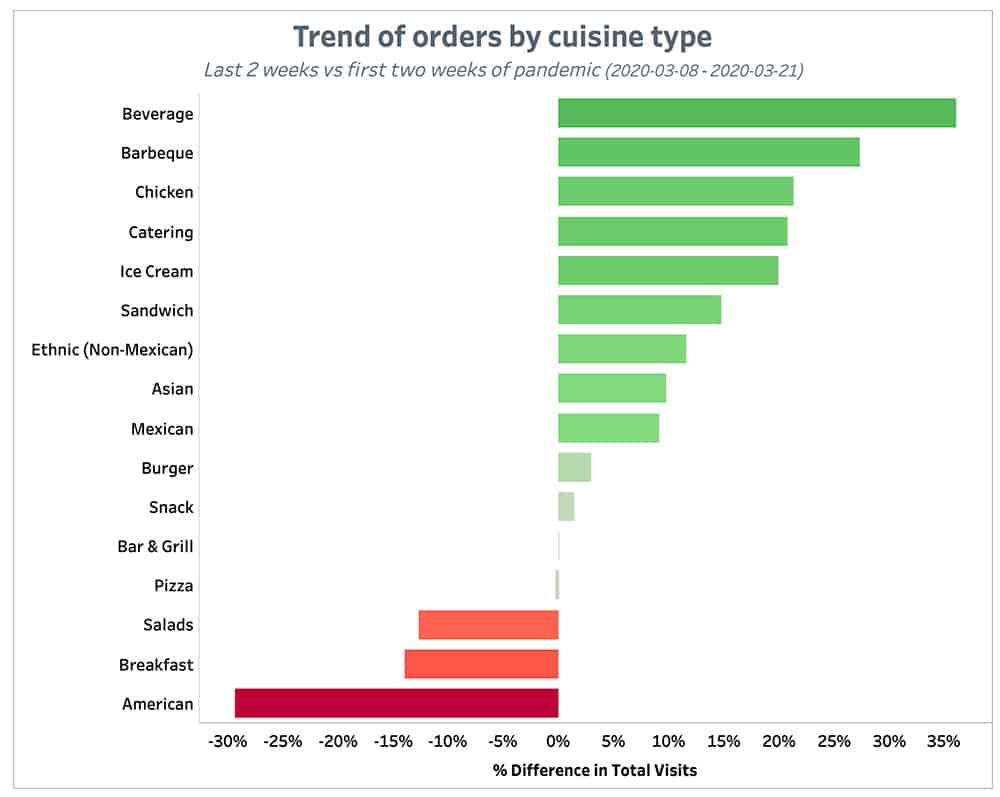

Trend of Orders by Cuisine Type

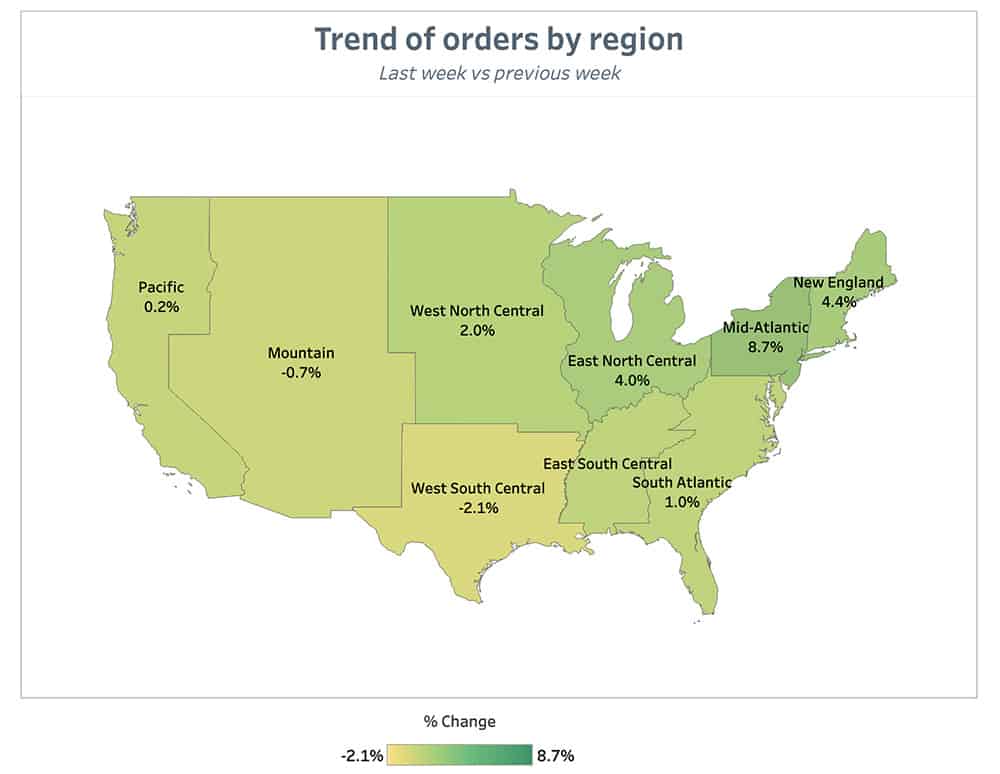

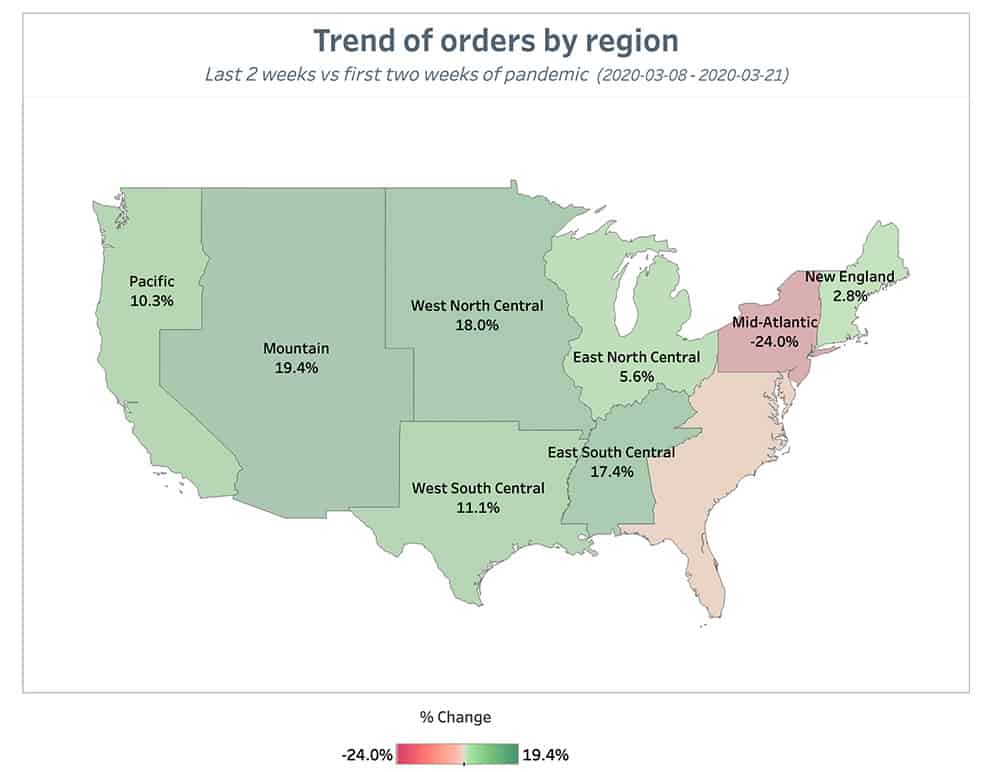

Trend of Orders by Region

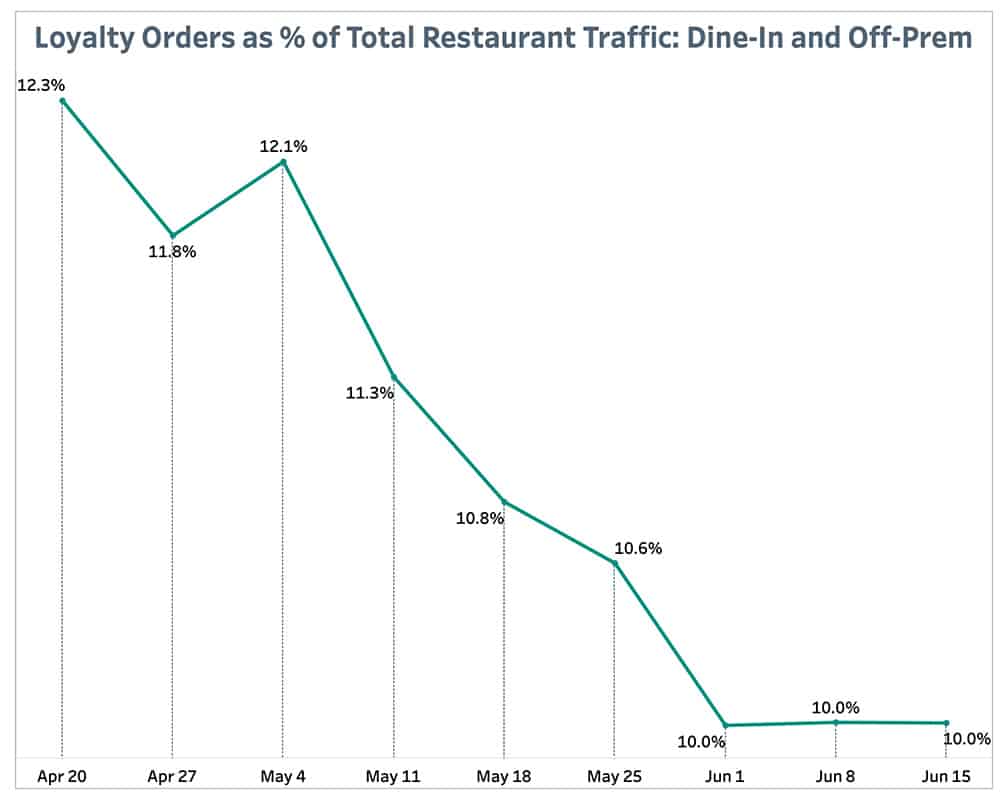

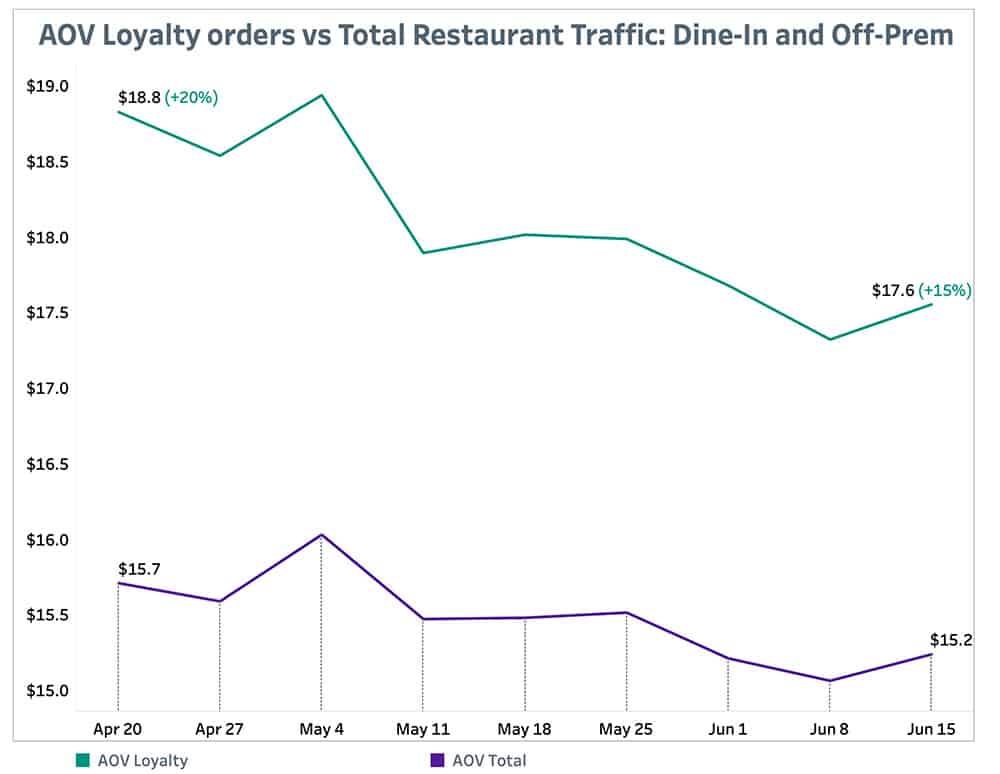

Loyalty Trends

Consumer Preferences

About the data:

The underlying data for this analysis is from 100+ brands over the last 9 weeks.

View previous weeks data:

- Weekly Industry Report for June 14

- Weekly Industry Report for June 7

- Weekly Industry Report for May 31

- Weekly Industry Report for May 24

- Weekly Industry Report for May 17

- Weekly Industry Report for May 10

- Weekly Industry Report for May 3

- Weekly Industry Report for April 26

- Weekly Industry Report for April 19