Punchh is partnering with Hathway to analyze the latest restaurant industry trends on a weekly basis to help our customers navigate the COVID-19 crisis and the new economic environment.

WEEKLY PULSE TREND REPORT

As a growing number of states across the US order the closure of restaurant dining rooms due to COVID-19, executives are scrambling to stem the tide of sales decline that will almost surely follow. To help these restaurant brands make informed decisions during this critical time, Hathway and Punchh have joined together to provide a weekly report analyzing the recent changes in behaviors amongst loyalty customers and predicting what will happen next. Following our initial trend report from March 21, this week’s report examines data from February 16, 2020 through April 18, 2020.

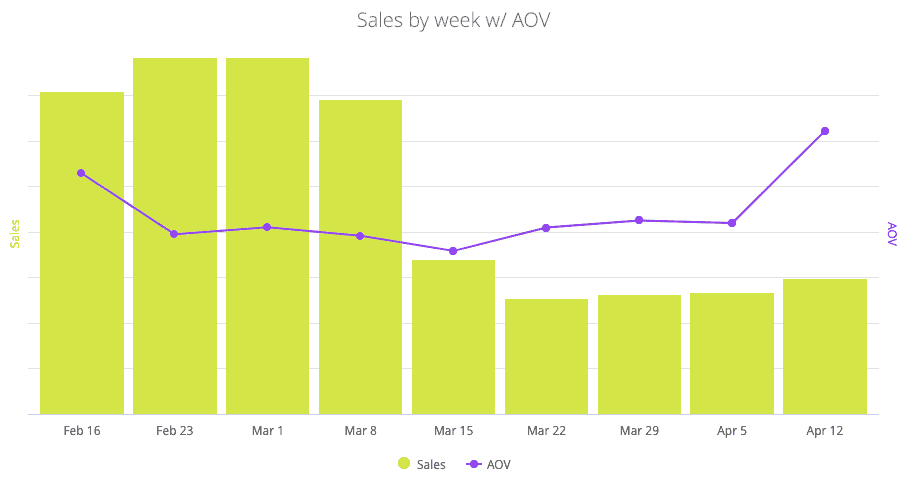

WEEK-OVER-WEEK SALES GROWTH CONTINUES WITH 12% GROWTH OBSERVED LAST WEEK VS WEEK PRIOR. REVENUE GROWTH OUTPACED AOV GROWTH, IMPLYING CUSTOMER GROWTH.

OBSERVATIONS

- Sales have normalized and are showing slightly growth each week.

- Last week 12% growth was seen vs last week. This is a significant jump compared to the 3% weekly growth trend the past two weeks.

- AOV growth jumped 6% last week vs. week prior.

THOUGHT STARTERS

- Focus on maintaining your active customer base to mitigate any further declines.

- Build strategies to start engaging with those customers that dropped off over the past month to win back through convenient and safe delivery or pick-up methods..

Sales by Week with AOV

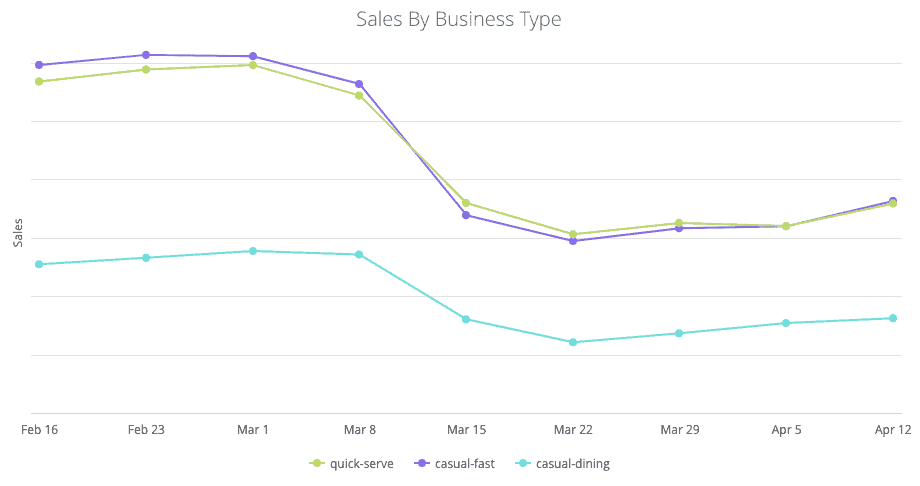

WEEKLY SALES CONTINUE TO SLIGHTLY FLUCTUATE BETWEEN 2-15% WEEK-OVER-WEEK GROWTH IN A SLOW MARCH TO MAKE UP THE SIGNIFICANT DROP OBSERVED MID MARCH.

OBSERVATIONS

- Quick Serve and Casual Fast saw the largest week-over-week growth at 12% and 14% respectively.

- Casual Dining saw a drop in growth rate to 5% vs. the past two week trend of 13% week-over-week growth.

THOUGHT STARTER

- Depending on your business, what are you doing to provide users a safe and compliant experience to place and deliver/pick-up their order?

Sales by Business Type

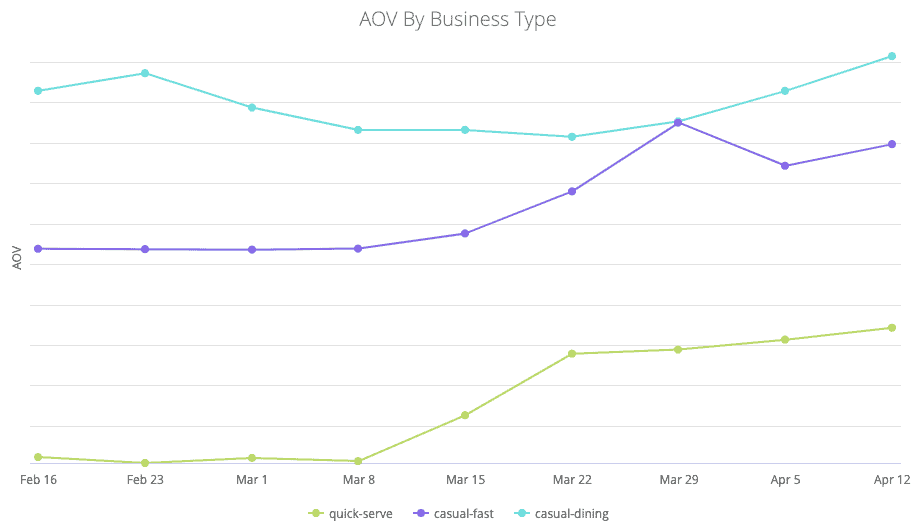

ALL BUSINESS TYPES OBSERVED A GROWTH IN AOV THIS PAST WEEK. CASUAL FAST SLIGHTLY RECOVERING FROM A SIGNIFICANT DROP LAST WEEK.

OBSERVATIONS

- Quick Serve & Casual Dining continue their AOV growth trend at 2% and 4% respectfully.

- Casual Fast observed 3% AOV growth, a reverse from the -5% drop last week but still down from the growth curve observed through March.

TAKEAWAY / THOUGHT STARTER

- Ensure your marketing messaging and cross-sell/upsell interactions are adjusted accordingly based on the context of what and when the user is purchasing.

AOV by Business Type

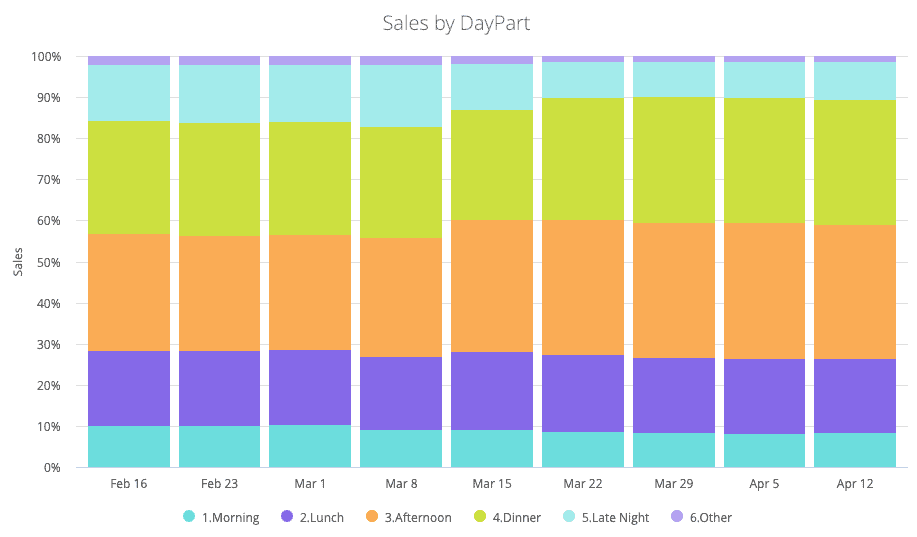

OBSERVATIONS

- Even with growth in sales, there are no observable changes in DayPart from last week.

- 24% of sales occur in Morning & Lunch day parts. 64% of sales occur between Afternoon and Dinner.

RECOMMENDATION

- Be sure restaurants are sufficiently staffed during the afternoon and evening to meet increasing demand during those times of day.

Sales by Daypart

TAKEAWAYS

1. Weekly sales are starting to slowly gain with another week of slightly stronger growth (12%) vs last week. This is driven by a mix of AOV and Customer growth.

-

Maintain your existing purchaser base and provide experiences to drive cross and upsells to drive AOV.

-

Continue expanding your purchasers by targeting lapsed customers from the past month and instil confidence to purchase again through convenience and safe delivery/pick-up methods.

2. AOV had the strongest growth in weeks with 6% week-over-week growth as customers continue to purchase slightly larger orders with cross or upsell items.

-

How is your business engaging with these returnings customers?

-

Are you targeting look-a-like customers to identify additional customers that may be open to returning to ordering?

3. Ordering dayparts remain consistent with slight consolidation of orders towards Afternoon & Evening.

- How is your marketing messaging adjusting to support the environment the user is in and their needs to support at-home orders?

Data Source

The data from this report has been anonymized and provided by Punchh and Hathway. This real-time, Punchh loyalty, online order and POS-transactions data was gathered from QSR, Fast Casual, and Casual Dining brands across the US.

Stay in the know. Subscribe to our bi-monthly newsletter to receive proven loyalty strategies, offer management techniques, and new trends in your industry. Sign up today!