Punchh is partnering with Hathway to analyze the latest restaurant industry trends on a weekly basis to help our customers navigate the COVID-19 crisis and the new economic environment.

WEEKLY PULSE TREND REPORT

As a growing number of states across the US order the closure of restaurant dining rooms due to COVID-19, executives are scrambling to stem the tide of sales decline that will almost surely follow. To help these restaurant brands make informed decisions during this critical time, Hathway and Punchh have joined together to provide a weekly report analyzing the recent changes in behaviors amongst loyalty customers and predicting what will happen next. Following our March 21 report, this week’s report examines data from February 16, 2020 through March 28, 2020.

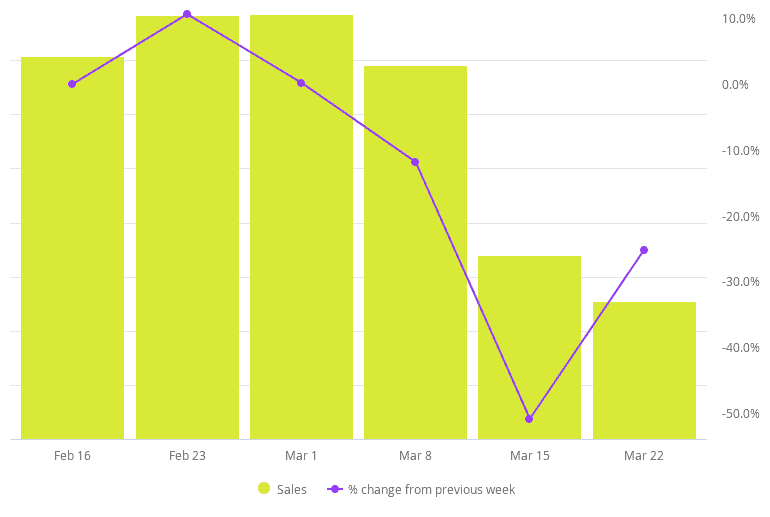

SALES DECLINE CURVE LESSENED THIS WEEK VS. PAST WEEKS

OBSERVATIONS

- Sales declined consistently week-over-week since Mar 1 with the largest drop being last week, Mar 15, with 51% decline.

- Week of Mar 22 broke the growing decline trend with a slowing 25% week-over-week decline.

TAKEAWAYS

- Sales is driven by Transactions multiplied by Average Order Value. Businesses need to break out these two metrics to determine where to focus efforts.

- Lessening decline in overall revenue is likely due to high amounts of online ordering/delivery that are buoying restaurant sales during this period.

Sales by Week with % Change

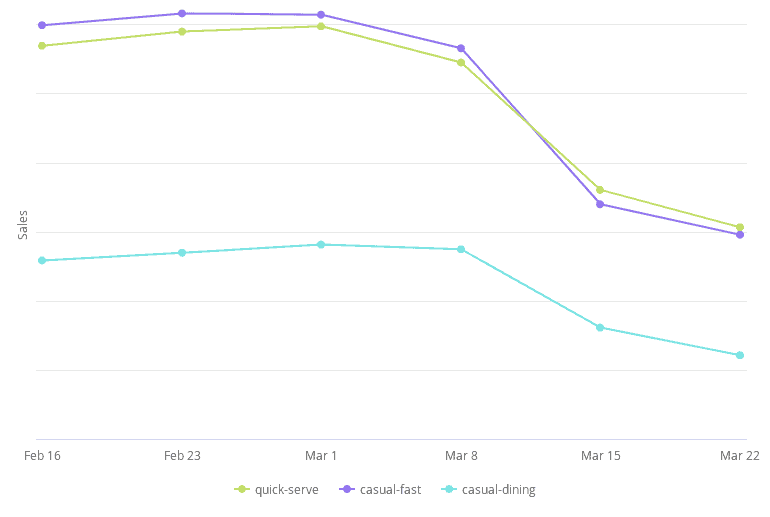

WEEKLY SALES DECLINE BEING OBSERVED ACROSS BUSINESS TYPES, SOME MORE IMPACTED THAN OTHERS

OBSERVATIONS

- All business types saw their decline curve lessen week of Mar 22 vs. previous weekly trend of between 34% and 41%.

- Casual Dining continues to have the highest rate of decline week of Mar 22 with a 25% decrease compared to 15% for Quick Serve and 13% for Fast Casual.

THOUGHT STARTER

- Depending on your business, what are you doing to provide customers a safe and compliant experience to place and deliver/pick-up their order?

Sales by Business Type

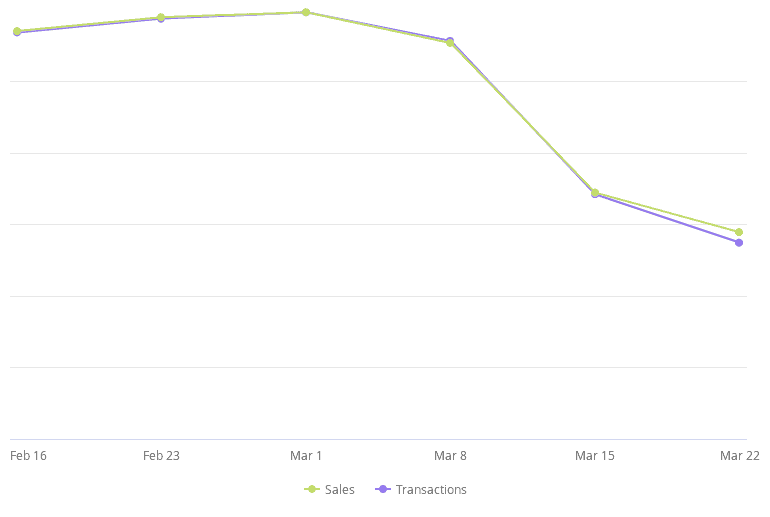

POSSIBLE SHIFT TOWARDS HIGHER REVENUE ORDERS

OBSERVATIONS

- Drop in visits & transactions are the largest driving factor of sale impact.

- Look at AOV to validate the increased gap between transaction and sales trends.

TAKEAWAYS

- Loyalty is a key factor in increasing AOV and is an important tool for restaurants to maintain steady revenue during times of high uncertainty.

- Integrate marketing messages that instill safety and provide convenience and/or savings to the customer to drive confidence in purchase.

Sales & Transactions by Week

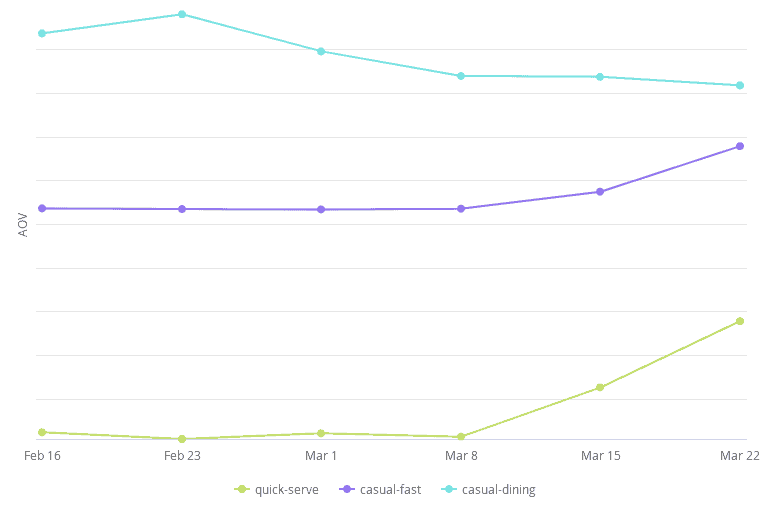

QSR AND FAST CASUAL RESTAURANTS CONTINUE TO SEE INCREASE IN AOV

OBSERVATIONS

- AOV has been consistently flat in February with 0% trending growth each week but saw 11% week-over-week growth the week of Mar 15 and Mar 22.

- Quick Serve is leading AOV growth with average 11% week-over-week increase the past two weeks.

- Fast Casual saw its most substantial AOV growth this past week with 6% vs 2% last week.

- Casual Dining AOV has remained steady with minimal change.

TAKEAWAY

- Ensure your marketing messaging and cross-sell/upsell interactions are adjusted accordingly based on the context of what and when the customer is purchasing.

AOV by Business Type

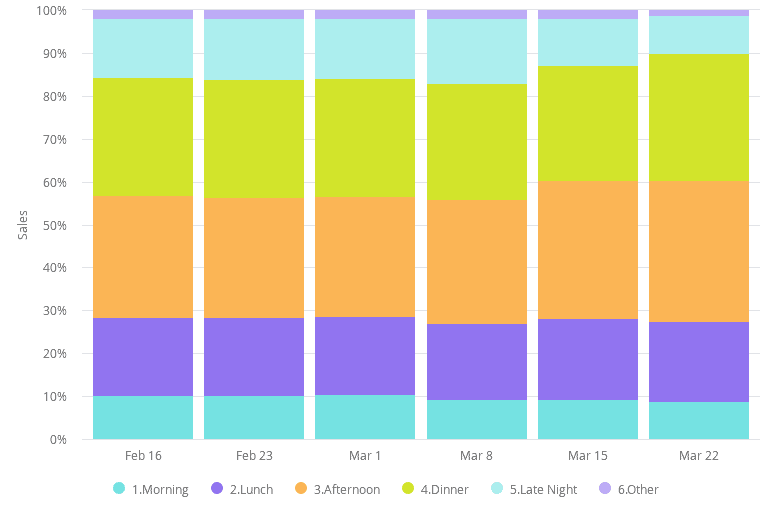

SLIGHT RISE IN ORDERS DURING AFTERNOON AND EVENING HOURS

OBSERVATIONS

- Morning and Lunch day parts are seeing a small amount of orders (1-2%) are shifting right to the later day parts.

- Late Night has had the largest drop from 14% order share to 9% this past week. These orders appear to be shifting left to the Evening day part.

TAKEAWAY

- Be sure restaurants are sufficiently staffed during the Afternoon and Evening to meet increasing demand during those times of day.

Sales by Daypart

TAKEAWAYS

1. Sales is impacted primarily by drop in business visits. Businesses can segment their customers into two primary buckets to help drive sales:

- Active customers still purchasing and how to increase their AOV.

- Lapsed customers who stopped purchasing in the past two weeks and how to instill confidence to purchase again.

2. Sales decline is being mitigated slightly from an increase in AOV for those businesses that support home delivery and low-touch pick-up like curbside.

- Is your business supporting these in-demand delivery methods?

- How are you helping customers expand their orders to support better convenience?

3. Customer purchase behavior is consolidating in time towards afternoon and evenings. This is driven by a mix of consolidating restaurant hours and shift in customer environment while in home isolation.

- How is your marketing messaging adjusting to support the environment the customer is in and their needs to support at-home orders?

Data Source

The data from this report has been anonymized and provided by Punchh and Hathway. This real-time, Punchh loyalty, online order and POS-transactions data was gathered from QSR, Fast Casual, and Casual Dining brands across the US.

Stay in the know. Subscribe to our bi-monthly newsletter to receive proven loyalty strategies, offer management techniques, and new trends in your industry. Sign up today!