Starting last week, Punchh is partnering with Hathway to analyze the latest restaurant industry trends on a weekly basis to help our customers navigate the COVID-19 crisis and the new economic environment. Here is our first post, which you can also find on Punchh’s LinkedIn channel. Stay tuned this week for another update.

WEEKLY PULSE TREND REPORT

As a growing number of states across the US order the closure of restaurant dining rooms due to COVID-19, executives are scrambling to stem the tide of sales decline that will almost surely follow. To help these restaurant brands make informed decisions during this critical time, Hathway and Punchh have joined together to provide a weekly report analyzing the recent changes in consumer behavior and predicting what will happen next.

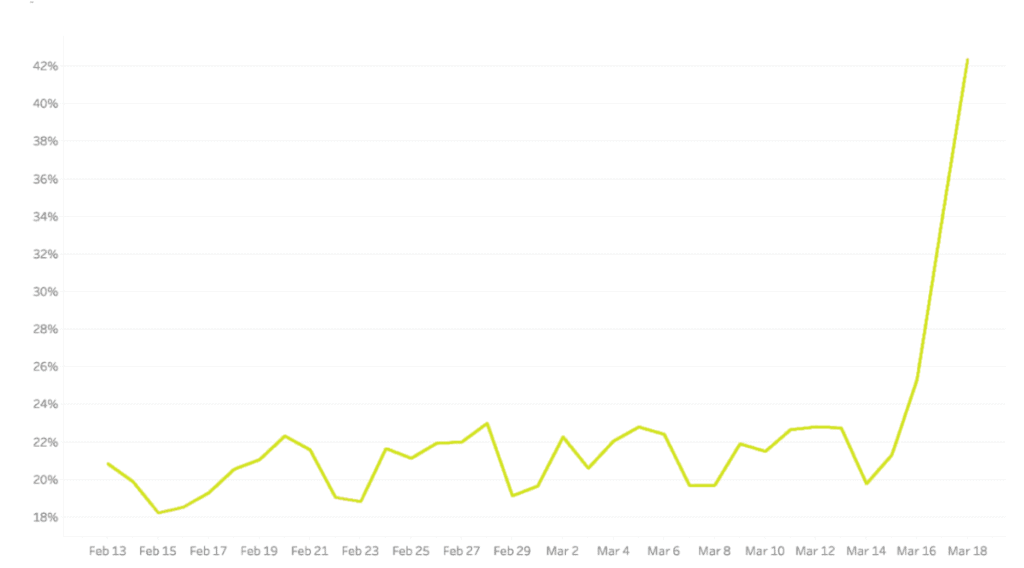

ONLINE ORDERS REPRESENT ALMOST HALF OF ALL TRANSACTIONS

While online orders usually hover at around 25% of all transactions, as of March 16th we are seeing a jump that we

expect to gradually continue to increase into next week.

Online Orders as a % of Total Transactions

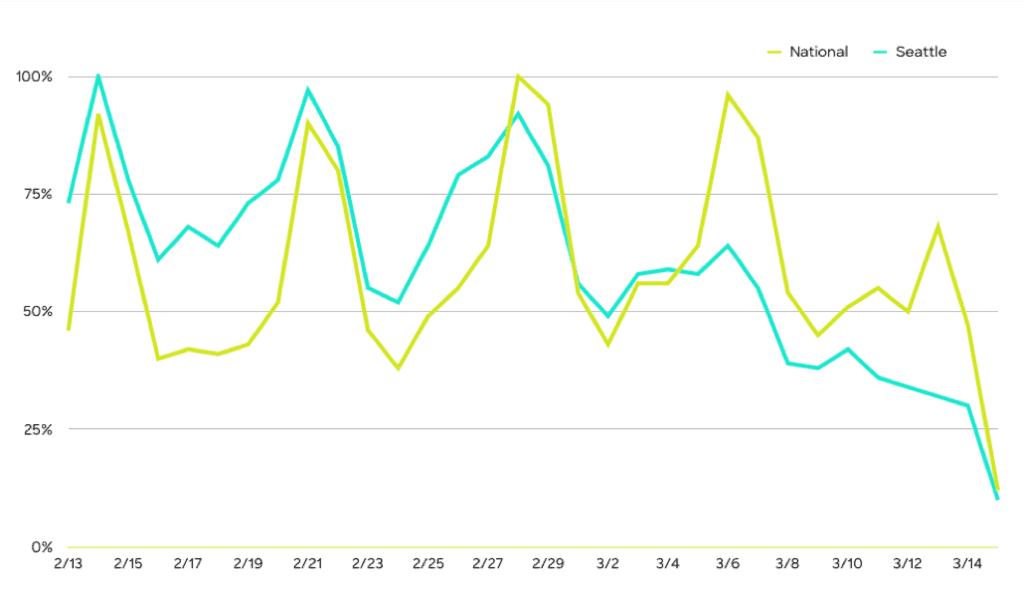

US EXPECTED TO FOLLOW SEATTLE CONSUMER TRENDS

Located in the state with the first COVID-19 case, Seattle has seen restaurant visitations and sales pull back nearly a week or two ahead of the rest of the country. Similar trends across all restaurant segments are expected.

Nationwide Visits vs. Seattle Visits (Scaled)

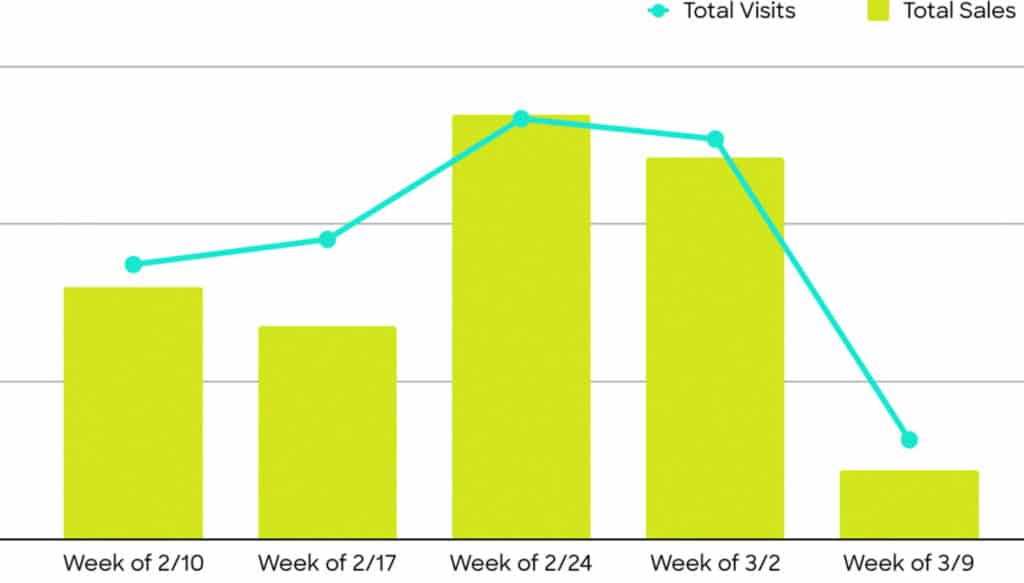

FAST CASUAL AND QSR FEEL IMPACT FIRST

Consumers pulled back from visits and spending at fast casual and QSR restaurants as soon as CDC social distancing recommendations were made. Surprisingly, casual dining restaurants were not affected as quickly, but this is expected to change within the coming week as more broad shelter in place orders come into effect.

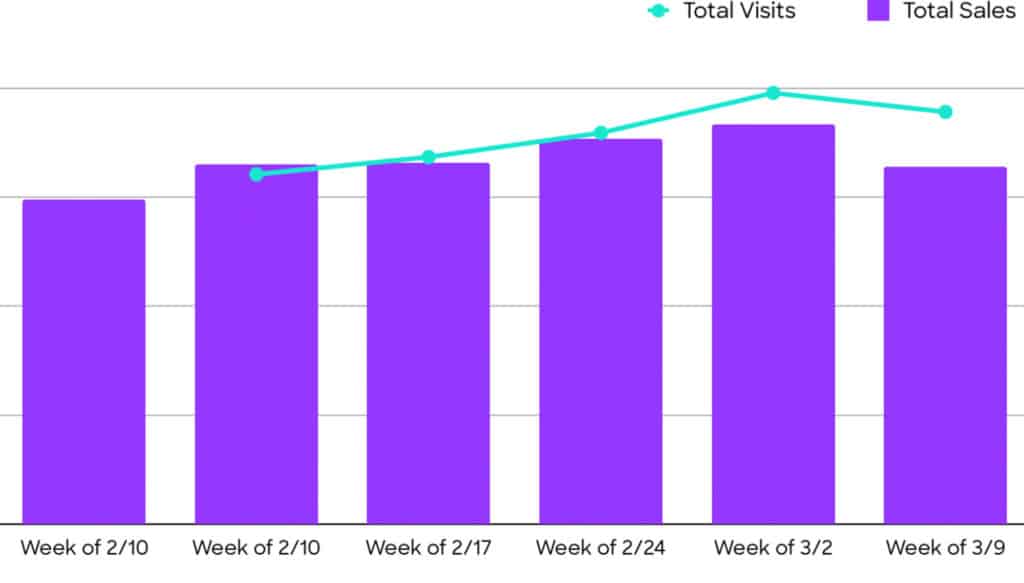

Fast Casual Nationwide Visits & Sales

QSR Nationwide Visits & Sales

Casual Dining Nationwide Visit & Sales

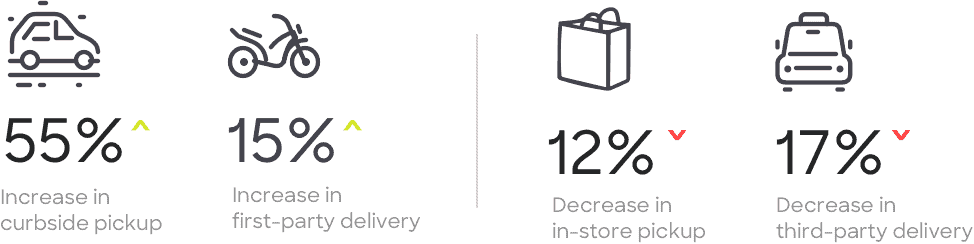

SHIFT TOWARD CURBSIDE PICKUP & FIRST-PARTY DELIVERY

While in-store pickup orders are down, curbside pickup is seeing over a 50% lift when comparing the latter half of February with the first half of March. Restaurant brands are already starting to adapt to support this shift by operationally facilitating curbside pickup in stores. Additionally, brands that have their own delivery are seeing an uptick, while those relying on third-party are seeing a drop.

Hand Off Mode

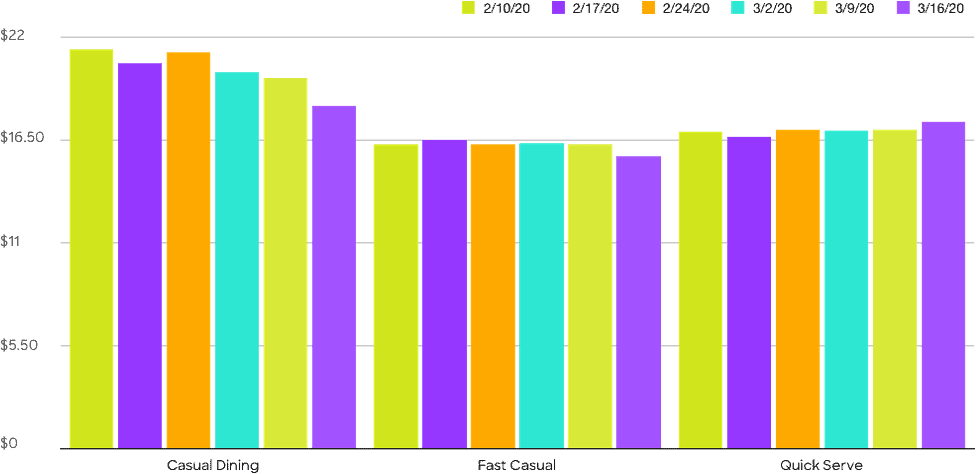

POSSIBLE AOV REBOUND FOR QSR

While AOV for casual dining and fast casual restaurants has declined in the past 2 weeks, QSR saw an initial dip last month but is showing strong signs of recovery. With more families home together during this time, we may expect to see a continued rise in QSR AOV.

Average Order Value By Week

TAKEAWAYS

Over the past two weeks, significant changes to consumer behavior have directly impacted the entire restaurant industry regardless of segment type. Digital and marketing teams are pivoting to ensure they are adapting quickly to changing customer needs. As social distancing has become the new normal so has the shift to online ordering which is soon to become the most common way to order. To further understand where the industry is headed, examining leading indicators in geographic regions like Seattle provide insights. We can expect further decreases in visitations but opportunities to expand hand off mode solutions and incentives that drive higher basket sizes will shape priorities in the near term.

Data Source

The data from this report has been anonymized and provided by Punchh and Hathway. This real-time, Punchh loyalty, online order and POS-transactions data was gathered from QSR, Fast Casual, and Casual Dining brands across the US.

Stay in the know. Subscribe to our bi-monthly newsletter to receive proven loyalty strategies, offer management techniques, and new trends in your industry. Sign up today!