What Every Restaurant Segment Needs to Succeed

Over the past several years, the restaurant industry has grown across all four restaurant segments. The restaurant industry is typically segmented according to the level of service customers receive, including the speed and amount of service provided to guests. The four segments quick service (QSR), fast casual (FCR), casual dining (CDR) and fine dining (FDR) are also typically one of the economy’s top employers.

Restaurant sales of food and drink had grown to $800 billion in 2017, with projected sales for 2020-2021 expected to reach $889 billion. While the pandemic and changing times have caused a strain on operators with tighter labor pools, shifting consumer preferences and varying local, state and federal mandates — the foodservice has a bright future, according to the National Restaurant Association.

The pandemic has brought to the forefront the need for restaurants to have the means to digitally communicate with their guests, provide off-premise services and do more to remain top-of-mind in order to capture more dollar-spend.

Additionally, consumers’ need for convenience means all restaurant segments must stay on top of technology innovation and investment. Evolving mobile and smart technology have created a fast-paced industry that needs its systems to be integrated and constantly collecting data across every guest touchpoint.

1. Quick Service Segment Embraces Technology to Deliver Sales & CLV

The quick service and full-service restaurants segments make up 73.1% of all food-away-from-home sales in 2019. The quick-service industry got its start post WWII. Many women who had begun to work outside the home during the war, remained doing so. The American economy was booming, and eating out, which had previously been a luxury, was becoming a necessity as families needed a quick, inexpensive meal both at lunch and dinner time.

The QSR segment is defined by its limited selection of food, limited service, including no table service and focus on speed of preparation and delivery. Traditional fast-food locations generally have a check average between $4-$9. Guests come to QSRs to get their food ASAP.

Measuring and tracking cook times and the time it takes from when food is finished cooking to being given to the customer offers QSRs their speed of service time. Analytics from kiosks, drive thru sensors, POS and kitchen display data can help play a role in delivering on this metric. An integrated loyalty program provides further guest data to continue enhancing the customer experience. McDonald’s and Wendy’s recent launch of their rewards programs highlights this segment’s interest in acquiring new customers, providing personalization and delivering an enhanced experience.

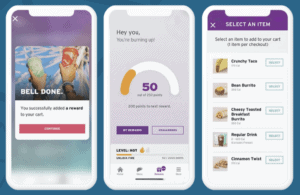

Taco Bell leads the customer segment in loyalty program membership. It’s a top 10 fast-food brand, according to FSR magazine, that has a massive, cult-like following. The Taco Bell rewards program powered by Punchh delivers experiential rewards to fans through highly innovative campaigns that align with their large Gen Y and Z guests’ interests. Learn more about Taco Bell’s epic marketing and loyalty tactics by viewing the on-demand webinar: Why Taco Bell® Believes There Has Never Been a Better Time to Self-Disrupt.

Taco Bell leads the customer segment in loyalty program membership. It’s a top 10 fast-food brand, according to FSR magazine, that has a massive, cult-like following. The Taco Bell rewards program powered by Punchh delivers experiential rewards to fans through highly innovative campaigns that align with their large Gen Y and Z guests’ interests. Learn more about Taco Bell’s epic marketing and loyalty tactics by viewing the on-demand webinar: Why Taco Bell® Believes There Has Never Been a Better Time to Self-Disrupt.

2. Fast Casual Concepts Heat Up the Industry

The fast-casual concept originated in the 1990s but became popular in the mid-2000s. The segment was built on the premise of more healthful food prepared with better ingredients than those at fast-food chains. Fast-casuals picked up steam due to the recession in 2008, skyrocketing rents and rising food costs. They have grown significantly in dominance with about 17,300 FCRs bringing in $19 billion in sales in 2009 to more than 34,800 in 2018 with sales of $47.4 billion, according to Technomic research.

The fast-casual segment implements a self-service or limited service format. Food is prepared to order and made with fresh (or perceived as fresh) ingredients, yet done quickly. Guest management is important as some guests dine in while others dine off-premise. Check averages are generally above $10 for the fast casual segment.

Additionally, FCRs split the difference between chef-driven, full-service restaurants and multinational fast food outlets. Chains such as Five Guys, The Halal Guys, Schlotzsky’s, El Pollo Loco and Fazoli’s promised fresh, sometimes organic ingredients, occasionally even sourced from nearby farms.

Fast-casual operators need to manage the diner’s experience whether that be in the restaurant, or for order ahead for pickup or for delivery. This concept needs the ability to track average order and analyze trends to determine peak hours, shifts and seasons for revenue. FCRs with the right technology also have the capability to throttle orders and adjust off-premise pick-up times to account for it. Features such as these help off-premise guests receive their food hot, fresh and without delay while walk-in traffic continues uninterrupted.

During the pandemic, brands such as Schlotzsky’s and El Pollo Loco turned to their customized Punchh loyalty programs to help them drive sales and pivot their business operations. Read about Schlotzsky’s innovative tactic for increasing AOV during the initial outbreak of the pandemic in this customer success highlight. El Pollo Loco met customers’ preferences for off-premise dining by implementing curbside pickup. Learn how their customers rewarded them for adapting so quickly to the needs of their guests.

3. Casual Dining Customer Segment Growing Again

The casual dining restaurant segment evolved alongside the fast casual-concept. A number of factors contributed to its rise such as a strong economy, working middle class and an increasing number of households with two working parents. This concept was designed to attract the growing middle-class population with moderate prices and kids’ menus.

However, throughout the 21st Century, the casual dining segment has been in decline with customer traffic decreasing nine years in a 13 year period from 2000-2013. Millennials did not embrace the casual dining experience as did their parents due to a lack of innovation, perceived value, and healthy options.

Initially, the casual dining segment looked to offer guests a more economical choice over a fine dining experience. Menu selection became more varied than FCRs, yet moderately priced compared to fine dining. Today, this segment is often defined by their low-key atmosphere and decor, which is themed based on the type of food they serve.

The CDR concept offers full-service with guests being served at their tables. Check averages are generally $15-$50, excluding alcohol. However, a full bar is a distinguishing characteristic of this segment.

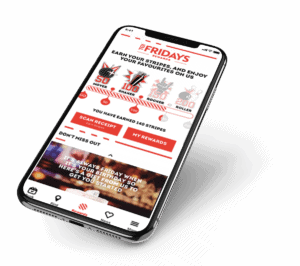

Brands that have adapted their strategies to those of the fast casual sector, such as Applebee’s, Texas Roadhouse, and Red Robin have seen improved business. Casual dining restaurant chains have gained momentum by providing tabletop tablets, pickup and delivery options, and loyalty programs that incentivize guests through personalized offers and rewards. Learn more about how TGI Fridays UK utilized Punchh technology in their restaurant environment to enhance the guest experience and grow loyalty revenue by 66%.

Brands that have adapted their strategies to those of the fast casual sector, such as Applebee’s, Texas Roadhouse, and Red Robin have seen improved business. Casual dining restaurant chains have gained momentum by providing tabletop tablets, pickup and delivery options, and loyalty programs that incentivize guests through personalized offers and rewards. Learn more about how TGI Fridays UK utilized Punchh technology in their restaurant environment to enhance the guest experience and grow loyalty revenue by 66%.

The guest experience plays a vital role in the casual dining segment. Back-of-house operations need to be running smoothly so customers receive a low-stress meal. Guest management outreach needs to be in place as well. With a reservation system that provides waitlist features and automation, data can be tracked in real-time. Operators also have the advantage of viewing historical averages to track turnaround times and identify areas for improvement.

4. Fine Dining Delivers Premium Restaurant Experience

The fine-dining restaurant segment began to rise by the end of the 19th Century in Europe and America. As travel along railways and steamships grew, taking people further distances, the need for restaurants increased. Taking their cue from Paris dining experiences, the United States began offering private tables, a la carte menu items, and having guests pay their bill at the end of the meal.

This concept relies on delivering a top-tier dining experience that highlights exceptional food and alcohol. Attention to prompt service and formal attire by the wait staff is emphasized. In return, guests generally pay a premium price for this type of restaurant experience, reserve their tables well beforehand, and dress up when visiting the location.

During the pandemic, FDRs had no choice but to adopt many of the operational changes made by the other restaurant segments. They shifted to off-premises channels, streamlining menus, setting up outdoor dining, discounting, bundling and selling alcohol-to-go. Brands such as Morton’s Steak House, Ruth’s Chris Steak House, and The Capital Grille looked to provide guests with value through off-premise convenience and when indoor dining resumed, offered a welcoming atmosphere that highlighted on-trend decor and lighting.

Today, the fine dining experience generally delivers a check average above $50, excluding alcohol, with an emphasis on dinner. However, extensive alcohol programs are usually offered. Operators need the technology to collect table service data to continually fine-tune their performance. Connected technology, integrated through a single platform, provides FDRs with the ability to consider everything from the back of the house to the front of the house, with an emphasis on complete guest management to deliver orders to perfection.

Next Steps for Every Restaurant Segment

Every restaurant segment continues to be challenged due to customers’ changing behaviors, technology advancements and shortages in labor during 2021. Understanding the dynamics of the various concepts highlights the universal importance of utilizing data to inform operations and deliver a better guest experience.

The right loyalty program offers all restaurant segments the ability to integrate their tech stack and expand their ecosystem of connectivity. They are then positioned to deliver on customers’ expectations by offering online ordering, delivery, pickup, contactless payments, messaging and more.

Data is collected, stored and unified from each of these systems so brands can leverage analytics to run smarter operations and have the agility to quickly change direction and scale as they grow in the future. Learn how the Punchh Loyalty, Offers & Engagement Platform has helped a range of concepts acquire, connect and grow a loyal customer base.

Stay in the know. Subscribe to our bi-monthly newsletter to receive proven loyalty strategies, offer management techniques, and new trends in your industry. Sign up today!