Punchh is partnering with Hathway to analyze the latest restaurant industry trends on a weekly basis to help our customers navigate the COVID-19 crisis and the new economic environment.

WEEKLY PULSE TREND REPORT

As a growing number of states across the US order the closure of restaurant dining rooms due to COVID-19, executives are scrambling to stem the tide of sales decline that will almost surely follow. To help these restaurant brands make informed decisions during this critical time, Hathway and Punchh have joined together to provide a weekly report analyzing the recent changes in behaviors amongst loyalty customers and predicting what will happen next. Following our March 21 and March 31 reports, this week’s examines data from February 16, 2020 through April 4, 2020.

FIRST WEEK-OVER-WEEK SALES GROWTH SINCE FEBRUARY

OBSERVATION

- Though sales are still down, the weekly decline trend over the past two weeks has improved substantially with last week having 3% positive growth over the previous week.

THOUGHT STARTERS

- With weekly sales leveling out, it’s time to focus on empowering those still purchasing and winning back those that have dropped out.

- Any marketing messaging should still be conscious of the reality of the world today.

Sales by Week with % Growth Change

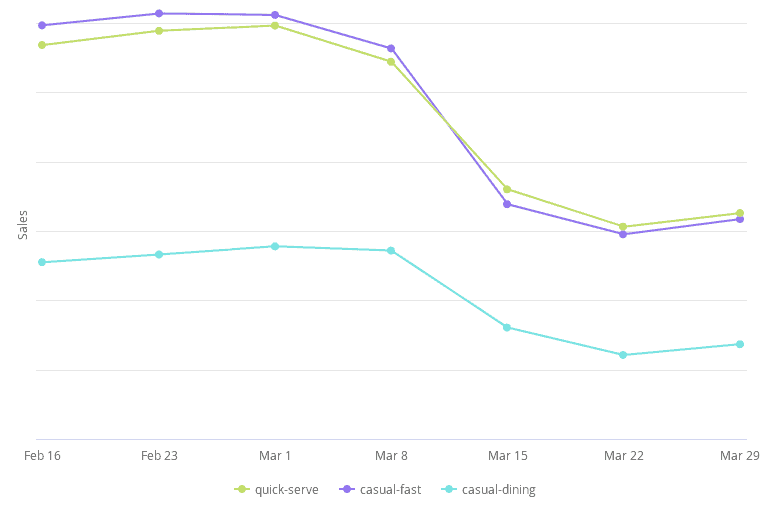

SALES GROWTH WEEK-OVER-WEEK ACROSS ALL BUSINESS TYPES, CASUAL DINING WITH LARGEST GROWTH

OBSERVATIONS

- Casual Dining had the best increase with 13% week-over-week growth. Up from the -25% decline last week.

- Quick serve & Casual Fast saw similar growths of 6% and 7% respectively.

THOUGHT STARTER

- Depending on your business, what are you doing to provide customers a safe and compliant experience to place and deliver/pick-up their order?

Sales by Business Type

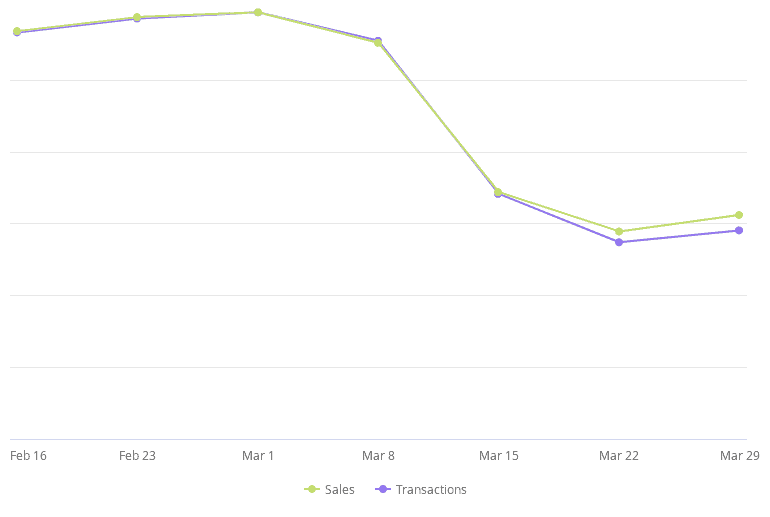

GROWING GAP IN SALES VS TRANSACTIONS IMPLIES INCREASED AOV

OBSERVATIONS

- Drop in visits is the largest driving factor of sales impact.

- Look at AOV to validate the increased gap between transaction and sales trends.

TAKEAWAYS

- Upsell/cross-sell experience solutions should be explored to drive AOV.

- Integrate marketing messages that instill safety and provide convenience and/or savings to the user to drive confidence in purchase.

Sales & Transactions by Week

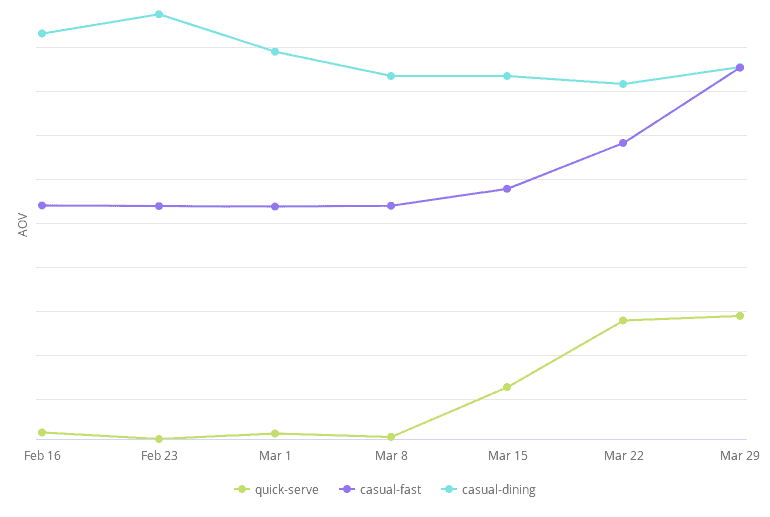

ALL BUSINESS TYPES SEE AOV GROWTH BUT FAST CASUAL OUTPACES OTHERS

OBSERVATIONS

- Weekly AOV growth continues at 11% growth from previous Trend. Showing stronger attribution to larger orders.

- Quick Serve was the early leader in AOV growth has been plateaued this past week with only 1% growth.

- Casual Fast saw its most substantial AOV growth this past week with 10%.

- Casual Dining AOV has remained steady with minimal change at 2% growth.

TAKEAWAY

- Ensure your marketing messaging and cross-sell/upsell interactions are adjusted accordingly based on the context of what and when the user is purchasing.

AOV by Business Type

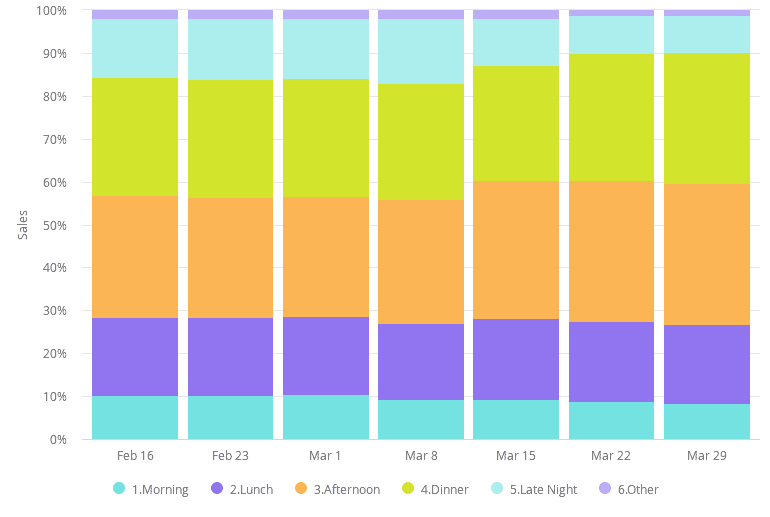

SLIGHT CONSOLIDATION TOWARDS AFTERNOON AND EVENING HOURS AS USERS ORDER WHILE SHELTERING IN PLACE

OBSERVATIONS

- Dayparts stayed mostly the same but with 1% declines in Morning and Late Night with consolidation towards Afternoon & Dinner.

- 64% of sales occur between Afternoon and Dinner.

TAKEAWAY

- Be sure restaurants are sufficiently staffed during the afternoon and evening to meet increasing demand during those times of day.

Sales by Daypart

TAKEAWAYS

1. Weekly sales decline has flattened out with the last week having the first week-over-week growth (3%) since February. Continue to target your defined customer segments to influence behavior:

- Active customers still purchasing and how to increase their AOV

- Lapsed customers who stopped purchasing in the past two weeks and how to instill confidence to purchase again.

2. Impact of visit decline on sales continues being mitigated slightly from an increase in AOV for those businesses that support afternoon & evening menus with home delivery and low-touch pick-up like curbside.

- Is your business supporting these in-demand delivery methods?

- How are you helping users expand their orders to support better convenience?

3. Customer purchase behavior has leveled out with little to no change in Daypart ordering patterns from the slightly consolidation of orders towards Afternoon & Evening.

- How is your marketing messaging adjusting to support the environment the user is in and their needs to support at-home orders?

Data Source

The data from this report has been anonymized and provided by Punchh and Hathway. This real-time, Punchh loyalty, online order and POS-transactions data was gathered from QSR, Fast Casual, and Casual Dining brands across the US.